As Bitcoin Shines, the Rest of the Crypto Universe is Severely Lagging

Dr. Boris Richard is the Founder of UpAI, LLC, a company providing regulatory and technical crypto advisory, and crypto and financial markets litigation expert services. He possesses a highly valuable combination of extensive TradFi experience and blockchain/digital assets expertise. Dr. Richard focuses on joint applications of AI and blockchain technologies, blockchain economics and token valuation, as well as cryptocurrency related expert work, virtual asset investigations, and responses to regulatory inquiries and enforcement actions. His clients include major law firms, cryptocurrency exchanges, digital asset issuers, custodians, Decentralized Finance platforms, blockchain foundations, and institutional investors. He has worked on regulatory and policy issues with the crypto industry for over seven years.

Previously, Dr. Richard spent 15 years in mortgage-backed securities, fixed income and derivatives markets as market strategist, bond trader and quantitative portfolio manager at Goldman Sachs, Barclays Capital, HSBC Securities, and several large multi-strategy and macro hedge funds. As proprietary portfolio manager, he had generated $400 million in investment profits and deployed more than $400mm in risk capital.

Dr. Richard is Member of the Wall Street Blockchain Alliance, Senior Fellow at the International Congress of Blockchain Legal Advisors, Member of Financial Club, Virginia State Bar accredited CLE course presenter, and Member of the World Economic Forum.

The arrival of a crypto-friendly regulatory and enforcement environment for the US digital asset industry in early November of last year held everyone’s expectations high with respect to the future performance of digital assets.

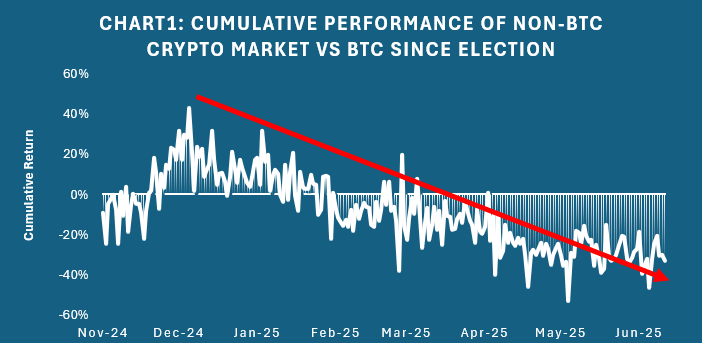

Initially, cryptos ex-BTC indeed collectively spiked in valuations in December - early January of 2025, with the relative outperformance versus Bitcoin by 30-43% during that period of time (See Chart1). However, the enthusiasm with respect to Altcoins quickly fizzled, and the market performance since then has become essentially a story of one asset – Bitcoin. As a result, the crypto universe remains sharply divergent in terms of its performance thus far this year. For context, according to Coinmetrics data, the cumulative return on Bitcoin from the Election Day through the middle of June has been 56.5%, whereas digital assets other than BTC have appreciated on average by only 23.3%. As of the middle of June 2025, the cumulative price underperformance of the non-BTC cryptocurrencies versus Bitcoin has been to the tune of -30% to -40% since the Election Day (Chart 1).

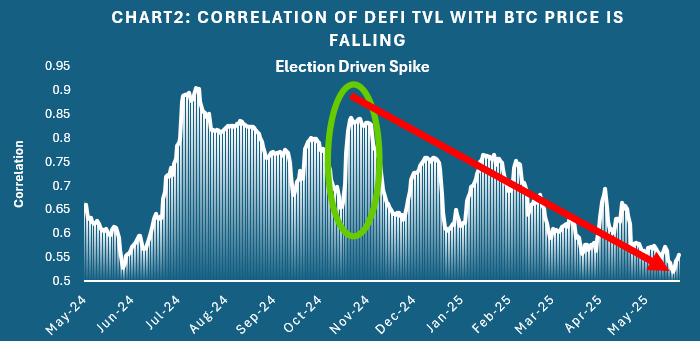

Setting aside the price action, the same divergent pattern could also be seen in terms of the volume of activity in non-BTC assets. Specifically, while historically DeFi TVL (Total Value Locked) takes its strong and positive cue from the price of Bitcoin, it has been less and less of the case since last December. Chart 2 shows that the correlation between BTC price weekly changes and TVL weekly changes has been on a steady decline since the middle of November 2024, declining from the peak correlation of 0.85% back then to below 0.6 just a few days ago. In other words, the sharply higher interest in Bitcoin from the institutional investors, large investment inflows into BTC ETFs, and the strong interest in BTC as the strategic reserve and corporate treasury assets – all have largely failed to spur a comparable investment and trading interest in Altcoins. In fact, the aggregate DeFi TVL declined from $120bn at the beginning of this year to $111.5bn as of the middle of June.

BTC generally outperforms other crypto assets in times of market distress, “black swans”, and sharp increases in market risks due to its "risk haven" status in the digital asset universe. This time around, however, sharp BTC outperformance has been solely driven by demand side pressures and nationwide and worldwide urge to build BTC strategic reserves and fill up BTC Treasury funds amidst the generally positive outlook for digital assets. It remains to be seen for how long this one-sided demand pressure on Bitcoin and the resulting poor relative performance of Altcoins will last, but the one-sided scarcity-, inflation-hedge- and fiat-debasement-protection-theory-driven upward pressure on BTC should give serious food for thought and raise questions about the long-term sustainability of BTC rally.

Major PoS Layer1 networks have been taking a serious note of the poor relative performance of their native assets versus BTC over the past six months. In the middle of June, Cardano founder Charles Hoskinson announced that he wants to diversify Cardano treasury by buying Bitcoin and specifically proposed converting $100mm of ADA into BTC and Cardano-native stablecoins. This represents between 8-9% of Cardano Treasury. I am far from asserting that this is an admission that ADA would not be able to compete on par with BTC over time in terms of user demand and ultimately pricing. In fact, Cardano indicated such conversion into BTC and stablecoins would generate yield which would then be used to buy back ADA to support its price. Still, the proposal to create value for the network by swapping the native asset for BTC looks to be an implicit admission of (Chart 1) the ongoing buying spree in BTC in the foreseeable future, and (Chart 2) insufficient availability of blockchain-native economic uses for ADA to generate value. And Cardano is not alone, as Polkadot is considering a popular proposal to slowly convert 500K DOT into tBTC – a tokenized version of BTC on the Ethereum chain.

The Cardano initiative apparently also reflects the evidence of multiple corporate structures adding BTC to its treasury holdings. While there is nothing wrong per se with such additions, and several crypto mining companies, crypto exchanges, corporates and crypto investment management companies have been steadily accumulating BTC in the last several years, the massive and fast influx of newcomers into the same strategy of late is a cause for concern. At the moment, public companies, private companies and governments combined hold 1.65MM BTC in their Treasuries, with the market value of $178bn (we exclude from this tally CEX, custodians, DEFI and ETF/funds). Just one week ago Coinbase warned that the trend of publicly traded companies growing Bitcoin treasuries could trigger systemic risks for all cryptos. Standard Chartered Bank warned in a June 3 research report that half of corporate treasuries risk going underwater if BTC falls below $90,000, while a 22% drop below average purchase prices could force BTC sell-offs and liquidations. During the 30-day span to June 11 alone, at least 22 entities added Bitcoin as a reserve asset, according to BitcoinTreasuries.net.

In fact, the BTC treasury “latecomers” like XXI, Gamestop, Semler Scientific, Metaplanet and the Blockchain Group combined have quickly plowed almost $6bn to accumulate 57,860 BTC at average entry costs of $102,507. Needless to say, these portfolios will quickly come under pressure even for modest retreats of BTC from its current price of $104,615.

All opinions expressed by the writers are solely their current opinions and do not reflect the views of FinancialColumnist.com, TET Events.